REITs are investments intended to finance the acquisition and/or construction of real estate, in order to obtain income from the rental of such properties.

In general, they specialize in one real estate sector, however, they are known for diversifying their portfolio of properties in various segments such as eng. centers, industrial or retail space.

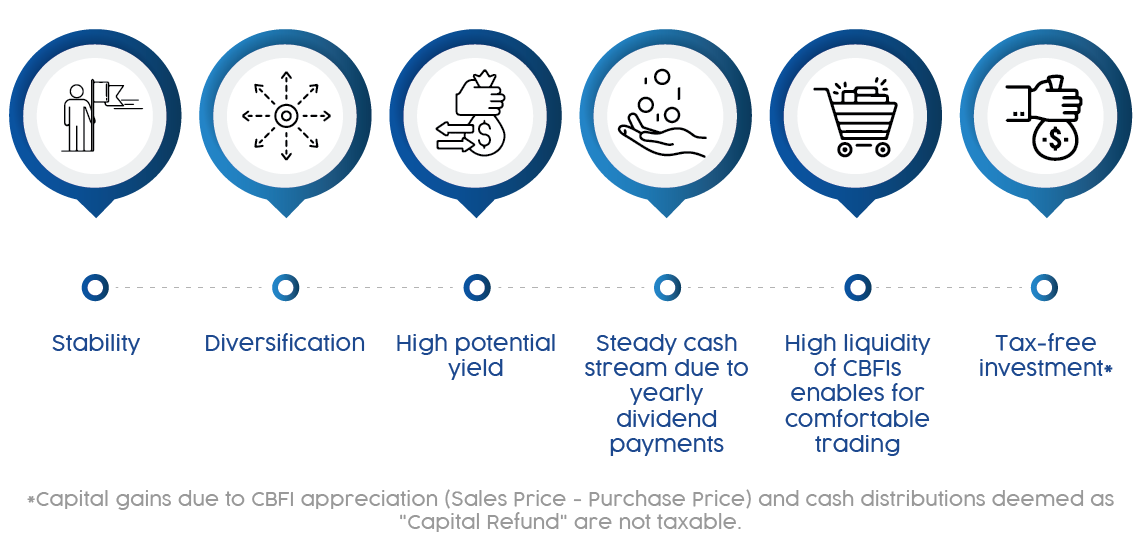

Historically, REITs have generated competitive returns that, coupled with their revenue capture, allow them to generate long-term incremental capital appreciation.

To do so, it is advisable to investigate the different options in the market and compare commissions, minimum opening amount and their different methods for the purchase and sale of investment instruments; selecting the one that best fits your profile. Once you have made your choice, you should open an account.

Once you have created an account with the brokerage house of your choice, the next step is to deposit the money in your account to start the process of buying and selling securities. There are two ways to make the purchase: i) Through a purchase order with an agent of your brokerage firm or, ii) Directly from your online account (it is worth mentioning that not all brokerage firms offer this option). On some occasions, you may be asked to provide the RFC of the Fibra to make the investment, which is: FDM170710T57.

According to the Mexican Income Tax Law, a REIT must distribute, at least annually, at least 95% of its taxable income. Thus, owning Fibra Nova securities allows you to obtain effective benefits from distributions, which are made on a recurring basis and deposited directly to your investment account.

Take time to learn about the Trust's quarterly results and other relevant information.